|

OFFICE

Many

suburban office users are seeking to take advantage of the relatively

soft general office market and historically low interest rates and are

purchasing as opposed to leasing. However, the amount of quality

suburban office product available for sale is relatively low…especially

for smaller stand-alone office buildings. Owners of office buildings

with vacancies may want to consider listing their properties for sale

to take advantage of this swell in demand.

|

INVESTMENT

Investment

real estate has been highlighted by increased levels of out-of-state

dollars flowing into West Michigan. The Grubb &

Ellis|Paramount Commerce team completed over $135 Million in sales in

2007, 80% of which was sold to out of state buyers. Activity

remains steady, however, instability of the debt markets has begun to

temper investor demand and has led to some price decreases.

Lenders and financial institutions are becoming increasingly more

cautious on many real estate transactions. The primary issue

impacting the marketplace in 2008 will be buyers ability to find

adequate financing.

|

RETAIL

2008

will provide some new challenges and opportunities. While the

newest retail sectors will continue to fill-in, the corridors with a

glut of 2nd and 3rd generation spaces will find it harder to lure

incoming tenants to their centers. New construction will continue

but at a very modest rate with a strong percentage of the building

being leased prior to breaking ground. Retail investment activity

within the West Michigan area will continue with investors being more

particular in their purchases.

|

INDUSTRIAL

Last

year, the West Michigan market continued to defy conventional wisdom by

showing a net gain in occupancy of almost 1.3 million square

feet. While we have seen and will likely continue to see some

local businesses shut down, particularly the smaller automotive

suppliers, we anticipate that 2008 will also show a net gain in

industrial space being filled. 2007 was a banner year for

industrial investment sales. While it will be very difficult to

replicate the dollar volume of last year's transactions, there are

still many buyers and sellers in the market looking for

opportunities. While the international credits markets are not as

liquid as in the past, local bank financing is at historically low

interest rates, creating opportunities for continued market

velocity. We anticipate that local industrial market will

continue moving forward in a positive direction as it has in recent

memory, despite all of the negative factors that exist in the global

marketplace.

|

PROPERTY MANAGEMENT

BOMA

Opposes Utility Plan Restructuring: The Building Owners and Managers

Association (BOMA) is strongly opposed to the proposed restructuring of

the electric energy legislation. The

restructuring is being positioned as a route to cleaner energy by

promoting increased renewable sources and this is a very worthy goal,

however under the proposed plan the cost of these sweeping changes will

be born largely by utility customers. Since PA 141 of 2000 – the

electrical deregulation act, Michigan has been very successful in

maintaining lower utility rates for it’s customers; under the proposed

restructuring, a 30-40% utility rate increase is predicted. Commercial

real estate owners are already bearing an additional burden because of

increased vacancies in their portfolios, an increase in utility rates

will only add insult to injury for real estate owners and do nothing to

attract new business and create jobs in our state.

|

TED SPREAD

Written By: Robert Bach

Senior Vice President

Grubb & Ellis Company

One

measure of the credit squeeze is the TED spread -- the difference

between interest rates on 3-month Treasury bills (“T”) and the 3-month

Eurodollar futures contract (“ED”) as represented by the dollar London

interbank offered rate (Libor). Treasuries are risk-free, while Libor

is a proxy for the credit risk of corporate borrowers. The recent

spikes coincide with heightened stress in the capital markets and

greater investor caution. Tighter credit is affecting all corners of

the economy including commercial real estate, which is seeing slower

leasing and investment activity.

|

|

|

|

|

Is Chicken Little Right?

By: Bill Bussey, CCIM

Everyday

we see articles in the newspaper and reports on TV as to how bad the

economy is and how things can only get worse. We're all familiar

with Chicken Little's famous line, but do you think he was really

foretelling West Michigan's future when he said, "the sky is falling,

the sky is falling?"

The reports we read about everyday are frightening:

-

Numerous large employers are announcing layoffs.

-

Unemployment is at a 20 year high.

-

Housing starts are almost non-existent.

-

Foreclosures are increasing.

We

have to be careful, however, that we remain conservative in our

business decisions, but at the same time make sure that talk of

recession doesn't become a self fulfilling prophecy. Put in

prospective, West Michigan certainly has its challenges, but the

underlying economy is actually strong and we have some positive

signs. For example,  in

2007 commercial construction was up 13% over last year and December was

actually double the previous year. These developments are

occurring throughout West Michigan, not just in downtown Grand Rapids.

Our downtown is very unique in that it is growing significantly ($1.3

billion of current construction). Much of this development will

eventually result in additional employment in the higher pay scale

areas such as medical research, creative development and even

manufacturing. in

2007 commercial construction was up 13% over last year and December was

actually double the previous year. These developments are

occurring throughout West Michigan, not just in downtown Grand Rapids.

Our downtown is very unique in that it is growing significantly ($1.3

billion of current construction). Much of this development will

eventually result in additional employment in the higher pay scale

areas such as medical research, creative development and even

manufacturing.

A recent study by Manpower

indicates that for the 2nd quarter in 2008, 23% of companies plan to

hire more employees and 74% expect to maintain current staff

levels. Only 3% are expected to reduce their payrolls. The

net effect of this, however, is that actual net employment (total new

hires less layoffs and anyone leaving the job market) is expected to

remain about the same.

Other factors adding to this area's stability are:

-

We generate the 5th largest number of patents per capita of all major cities in the US.

-

We

have the highest level of charity per capita of any city other than

Salt Lake City. Our population is generous with regular charities

and also with donations that help our area grow, such as new

educational buildings, new museums, new convention centers, etc.

This has been a very important factor in making Grand Rapids as

successful as it has been.

In

2008 we need to watch net employment growth, residential sales and

foreclosure rates. These indicators should give us good

information about the real direction of our economy. Regardless,

West Michigan should continue to do what it does best. Be

conservative, work hard and be creative.

Bill

Bussey has been a commercial realtor for over 25 years with an emphasis

on retail, land, and investment brokerage. He is recognized as

one of the foremost commercial brokers in West Michigan in his areas of specialty.

|

|

|

Property Management in the 21st Century

By: Anne Ficeli, CPM

What does a commercial property manager look like in the 21st century? Answer: a whole lot different than they did 25 years ago. Today’s commercial managers are dealing with clients who are much more sophisticated than ever before. Real

estate investors, particularly commercial investors, have very specific

goals and objectives in terms of their real estate investments. They

know what they are looking for in long and short term financial goals,

value enhancement, return on investment and cash flow. These

investors are looking for more than a “building manager”; they want a

well-rounded professional who can bring strategic, financial expertise

to the table and help drive the economics of the property.

To

meet the increasing expectations of property owners, the job

description for property managers has evolved into one closer to that

of an asset manager. Key responsibilities

often include: evaluating and analyzing lease transactions to ensure

that they are in line with short and long-term goals for the property,

identifying and implementing strategies to add or preserve value,

determining where and how improvements can be made to improve

performance and mitigate risk to name a few. In

addition, today’s property managers must be able to react to change

quickly, but more importantly, they must have a knack for anticipating

change. Commercial property managers must

play a part in helping property owners increase revenues and glean the

most value out of a property, which is always a primary objective for

an owner.

In addition to the performance of a property, owners have other expectations for their senior property managers. Due to the complexity of all of the relationships involved, real estate can be very high risk in terms of regulatory compliance. This has been heavily influenced in recent years by the likes of the Sarbanes-Oxley Act and Stark regulations. Both

of which were designed to monitor transactions between closely related

entities as well as to ensure key internal controls are in place and

monitored. Although a property manager may

not be responsible from a compliance standpoint, many are held

accountable for monitoring certain controls.

As

this evolution continues, the lines between a senior property manager

and an asset manager are becoming more and more blurred. Property

management professionals are being challenged to “step up” to meet the

needs and expectations of today’s real estate investors. Overall, this is great news for our profession. As

managers take measures to gain the knowledge necessary to take their

services to the next level, owners are gaining a new appreciation for

the role a property manager can play in the success of their investment.

Anne Ficeli is a Senior Property Manager for Grubb & Ellis|Paramount Commerce. Anne

offers over 15 years of property management experience throughout West

Michigan, she is a Certified Property Manager (CPM) and holds a license

in real estate.

|

|

|

Leadership in Sustainability

By: Christopher Beckering

The

City of Grand Rapids and the entire West Michigan region have taken a

national leadership role in the growing green building movement. Grand

Rapids has completed the highest number of LEED® (Leadership in Energy

and Environmental Design) Certified projects per capita in the country.

Following the example of office furniture manufacturers (such

as Steelcase, Haworth, and Herman Miller), universities (such as

Grand Valley State and Michigan State), institutions (Grand Rapids Art

Museum- the first LEED® Certified museum in the world) and

philanthropists (such as Peter Wege and the Grand Rapids Community

Foundation), retailers, office users and manufacturers are beginning to

recognize both the environmental and economic benefit of sustainable

development. While most people have a general understanding of

“green building”, even industry insiders are still learning the new

alphabet soup, buzzwords and advantages of the phenomena.

Chris

Beckering is a certified EcoBroker®. He is the first and only

commercial broker in Michigan to achieve this coveted designation as of

February 2008.

|

|

|

Market Overview

By: Gary Albrecht

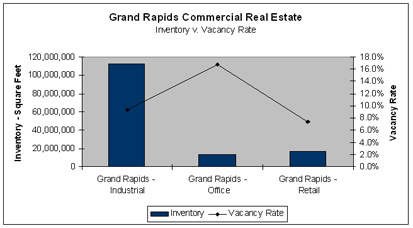

Industrial vacancy decreased 9.4% from Q1 2007 indicating that the industrial market is moving in the right direction. Office

vacancy increased slightly from 16.2% at the end of last year, mainly

due to 82,000 square feet of new construction completed during the

first quarter of 2008. Retail vacancy

rate decreased from 7.9% in 2007 to 7.4% in the first quarter of 2008,

indicating continued interest from national retailers

If you are interested in subscribing to Market Trends contact

Gary Albrecht Research Analyst 616.774.3500

Gary

Albrecht is the research analyst for Grubb & Ellis|Paramount

Commerce and is responsible for the preparation of the West Michigan

Market Trends covering the quarterly market conditions of the office,

retail and industrial markets in West Michigan.

|

|

|

Industrial Close-ups Industrial Close-ups

The

Grubb & Ellis|Paramount Commerce industrial team of Duke Suwyn,

Steve Marcusse, and John Kuiper are pleased to have had the opportunity

to represent L&V Development with its recent land acquisition,

industrial property acquisitions, tenant renegotiations, industrial

property leasing, and industrial property sales.

"I

have worked exclusively with the Industrial Team at Grubb &

Ellis|Paramount Commerce for all of my commercial real estate needs

over the last six years. Their specialized team approach, unparalleled

knowledge of the market, and personal integrity make them the clear

choice for me. Their work has been an integral part of my success and

it continues to be essential in helping me make the best real estate

decisions possible."

Larry Kerkstra, L&V Development

|

|

|

For further

information on Grubb & Ellis|Paramount Commerce, click on

links below and you will be directly connected:

■G&E|PC Website ■Company Brochure

■Press Releases ■2008 Forecast Booklet

■Featured Properties ■Our Offices

|

|